Economic Mobility Alliance

The Economic Mobility Alliance brings several of our most effective programs under one umbrella to foster greater collaboration and maximize our impact, increasing economic mobility for individuals of all backgrounds throughout every stage of their financial lives. Each of these programs contributes distinct elements toward comprehensive economic opportunity and lasting financial security.

We envision EMA as much larger than merely the sum of the Milken Institute’s existing efforts, as numerous outstanding organizations today are focused on economic mobility. With EMA, we will convene these organizations, and together, we will amplify our collective impact, fostering greater collaboration and advancing solutions more rapidly.

Invest America Accounts

Invest America Accounts provide universal investment accounts seeded at birth, aimed at helping individuals build long-term wealth and achieve economic security across generations.

Pathways to Capital

Pathways to Capital expands access to capital for underserved communities and entrepreneurs, enabling greater economic participation and growth through the programs listed below.

Pathways to Capital Programs

-

Initiative for Inclusive EntrepreneurshipInitiative for Inclusive Entrepreneurship removes barriers and offers essential support to entrepreneurs from underserved communities, fueling economic dynamism and job creation.

Initiative for Inclusive EntrepreneurshipInitiative for Inclusive Entrepreneurship removes barriers and offers essential support to entrepreneurs from underserved communities, fueling economic dynamism and job creation. -

Inclusive CapitalismInclusive Capitalism includes the historically Black college and university (HBCU) program dedicated to supporting HBCU graduates pursuing careers in asset management.

Inclusive CapitalismInclusive Capitalism includes the historically Black college and university (HBCU) program dedicated to supporting HBCU graduates pursuing careers in asset management. -

10,000 Communities10,000 Communities drives investments and resources into local communities to support sustainable economic growth and resilience.

10,000 Communities10,000 Communities drives investments and resources into local communities to support sustainable economic growth and resilience.

Financial Innovations Labs

Financial Innovations Labs develops creative solutions and scalable innovations to tackle complex financial challenges and broaden economic participation.

FinTech, Entrepreneurship, and Innovation

FinTech, Entrepreneurship, and Innovation employs cutting-edge financial technology to empower entrepreneurs and expand financial inclusion.

Veterans Community Initiative

Veterans' Community Initiative delivers tailored resources that enable military veterans to successfully make the transition into civilian careers.

Lifetime Financial Security

Lifetime Financial Security helps individuals better prepare for retirement, addressing the critical challenges of saving and investing effectively.

The IFC–Milken Institute Capital Markets Program

The IFC–Milken Institute Capital Markets Program develops human capital in emerging economies by educating mid-career government finance professionals and providing them with a lasting network; to date, we have supported 300 fellows across 65 nations, two-thirds of whom are in Africa and 50 percent of whom are women.

The World Bank–Milken Institute Public Financial Asset Management Program

The World Bank–Milken Institute Public Financial Asset Management Program supports sovereign governments in improving public asset management to drive long-term economic stability and growth.

Geo-Economics, Climate Resilience, and AI

Geo-Economics, Climate Resilience, and AI explores how global economic trends, environmental challenges, and technological advancements interact, developing strategies that enhance resilience and growth.

Economic Mobility Alliance

Most Recent Content

-

Rewiring for Wealth: Making the Pivot from Debt Dependency to Saving and Investing

Americans are drowning in a record $18.59 trillion of household debt, and breaking free requires combining personal financial discipline with institutional support to shift from mere survival to genuine wealth-building.Read ArticleImage

Cheryl L. Evans, JD

Director, Lifetime Financial Security, Milken Institute FinanceCheryl L. Evans, JD, leads the Lifetime Financial Security (LFS) Program of the Milken Institute’s Finance pillar. She frequently discusses a variety of issues related to financial security and retirement savings and has been cited in publications such as US News and World Report, Yahoo Finance, Bloomberg News, MarketWatch, CBS News, Pensions & Investments, McKnight’s Senior Living, and TheStreet. -

Capitalizing Community Lenders to Expand Affordable Small Business Finance

Across the United States, small businesses are essential drivers of job creation, innovation, and local economic resilience. Yet for many entrepreneurs—particularly those in low-income communities and communities of color—access to...Read ArticleImage

Camron Doss

Director, Milken Institute FinanceCamron Doss is a transformative senior leader with more than 30 years of specialized experience in strategic planning, stakeholder relations, external affairs, corporate communications, community and economic development, and business operations. At the Milken Institute, Doss leads the Initiative for Inclusive Entrepreneurship.

-

Rebuilding from the Bottom Up: The LA Fires One Year Later

January marks the one-year anniversary of the Eaton and Palisades fires that devastated Altadena, the Pacific Palisades, and Malibu, destroying over 16,000 structures, killing 31 people and leading to hundreds more related deaths, and...Read ArticleImage

Alexander Meeks

Director, 10,000 Communities Initiative, Milken Institute FinanceAlexander Meeks is a director at Milken Institute Finance. He focuses on helping communities accelerate resilient disaster recovery and adapt to extreme weather events. -

One Year After the Fires, A Lesson in Community Resilience

January 7 marks one year since wildfires tore through Los Angeles, making it the costliest wildfire event globally and contributing to more than $130 billion in extreme weather losses in the first half of the year alone.Read ArticleImage

Théo Cohan

Director, Innovative Finance, Milken Institute FinanceThéo Cohan is a director of innovative finance at the Milken Institute, focusing on communications and marketing strategies, and partnerships, and working with her team to develop and execute Financial Innovations Labs®. -

The Need to Reach Women as Consumers and Makers

Ever since the Industrial Revolution, society has struggled to fully comprehend the crucial economic role that women—especially working mothers—play in the economy.Read Article -

International Security, Economic Development, and US Strategic Competitiveness: USDFC Reauthorization

That the US International Development Finance Corporation (DFC) has emerged as a focal point of strategies for advancing US economic statecraft is of little surprise. US strategic competitiveness is coextensive with international security...Read ArticleThat the US International Development Finance Corporation (DFC) has emerged as a focal point of strategies for advancing US economic statecraft is of little surprise. US strategic competitiveness is...

Image

Matthew Aleshire

Director, Geo-EconomicsMatthew Aleshire is director on the Milken Institute’s Geo-Economics Initiative and helps to lead the work around the topics of climate change, the global financial architecture, and international political economy. Aleshire previously focused on global policy and government engagement for the Milken Institute, overseeing efforts to advance policy solutions across the Institute’s research and convenings. -

Federal Funding in Doubt? Create New State-Level Ecosystems that Back Community Development Financial Institutions

Earlier this month, the entire staff of the Treasury Department's Community Development Financial Institutions (CDFI) Fund was terminated as part of a large-scale reduction in force.Read ArticleImage

Rachel Reilly

Senior Director, Milken Institute FinanceRachel Reilly is the founder and CEO of Aces & Archers, a strategic advisory and consulting firm focused on addressing socioeconomic inequality by reimagining traditional models for economic growth and private investing. -

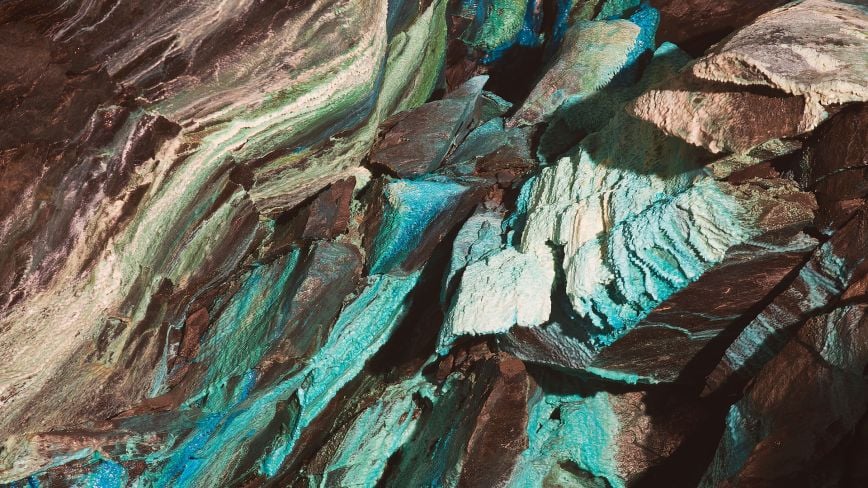

Investing in the Future – Innovations in Critical Mineral Supply Chains

The world needs minerals found in the Earth’s crust—and lots of them. Their prized properties render them essential. Smartphones use minerals to enable a touch response, emit glow and vibrations, provide high-quality audio and video, and...Read Article -

20 Years After Katrina: Rebuilding for Real Resilience

Two decades ago, the levees broke in New Orleans during Hurricane Katrina, and the results broke our hearts. The storm exposed one city’s vulnerability to a hard-charging Category 3 hurricane and tragically upended the lives of the city’s...Read Article

Other Organizations Advancing Economic Mobility

Seeded by commitments from Apollo Global Management, Ares Management Corporation, and Oaktree Capital Management, creates pathways for HBCU students to enter and thrive in the alternative investment management industry.

Works to remove barriers and empower individuals to achieve better, richer, and fuller lives through rigorous academic research, sound public policy solutions, and by fostering a holistic vision of human flourishing.

Provides targeted support and training to improve career opportunities at the firm’s portfolio companies, particularly for underrepresented and economically disadvantaged groups.

Promotes global economic stability, fosters international financial cooperation, and advances inclusive economic growth.

Works to expand economic opportunity and access to capital, disrupt poverty, and empower individuals through financial literacy, economic education, and programs that foster inclusion.

Promotes broad-based employee ownership programs that create meaningful wealth-building opportunities for employees, uplift families, reinvigorate corporate cultures, and improve business performance.

Aims to advance philanthropy throughout the investment industry; investment funds commit at least 5% of a selected funds’ performance fees to charitable organizations focused on healthcare, education, and other drivers of well-being.