Medical care is a large financial burden on many middle- and low-income Americans’ lives. This burden can be so great that the financial impact of obtaining medical care can itself cause meaningful degradation in a patient’s quality of life, a phenomenon referred to as financial toxicity, as explained in JAMA Oncology. For most Americans, health insurance is the primary line of defense against financial toxicity.

Health insurance, like all forms of insurance, does not directly protect against harm. Just as car insurance does not prevent a fender-bender, health insurance does not shield a person from developing an illness or injury. Rather, insurance protects from the financial consequences of harm: repairing a car when it is damaged or paying for medical treatment when a person gets sick.

As discussed in the American Economic Journal: Economic Policy and the Journal of Public Economics, an established causal link exists between gaining health insurance and sizable reductions in adverse financial outcomes such as having debt in collections. There is also causal evidence that those who have their health insurance (specifically Medicaid) taken away have a subsequent increased risk of carrying delinquent debt. The financial protection feature of health insurance is of great policy importance as any policy aimed at health insurance does double duty as a policy impacting household finance.

A recent example of the impact of health insurance on households’ finances is the “Medicaid Unwinding,” or returning to normal Medicaid operations after the ending of some of the rules from the Families First Coronavirus Response Act (FFCRA). The FFCRA temporarily required states to maintain continuous enrollment for those already in a state Medicaid program, meaning that those who had eligibility lapse or who missed re-enrollment would not lose coverage. The Consolidated Appropriations Act, 2023 removed the continuous enrollment rule as of March 31, 2023, and gave states 12 months to return to normal operations.

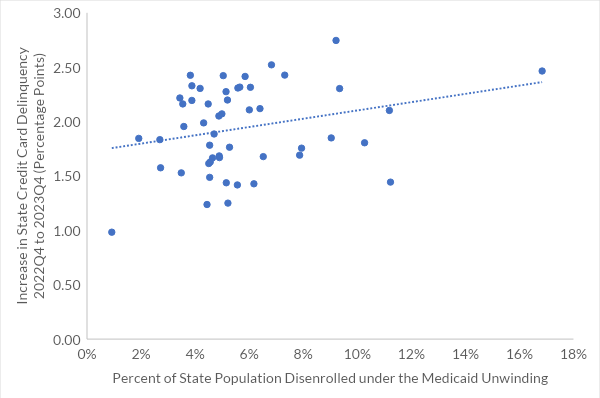

During this time frame, a sizable portion of Medicaid enrollees were disenrolled, according to KFF. The proportion of a state’s total population losing coverage ranged from under 1 percent in Wyoming to over 16 percent in Oklahoma. A correlation between the disenrollment rate and measures of household financial stability can be seen using credit card data from the Federal Reserve: States that had a larger proportion of their population removed from Medicaid during the Medicaid Unwinding also, on average, saw an increase in the likelihood of having delinquent credit card debt during the same time period.

State Medicaid Disenrollment and Increase in Proportion of Credit Cards in Delinquency

Source: Federal Reserve Bank of New York Quarterly Report on Household Debt and Credit (2023), Kaiser Family Foundation Medicaid Enrollment and Unwinding Tracker (2024), US Census Bureau (2023)

The takeaway is clear: Any policy that impacts health insurance coverage needs to be handled with caution. Health insurance and household financial stability are linked, and any policies that change insurance coverage spill over into the economy more broadly via household finance. Policymakers should carefully consider the connection between household financial stability and insurance coverage in their cost-benefit analyses of health insurance policies.