On July 10, the Biden administration imposed tariffs on imports of steel and aluminum from Mexico that contained metals smelted outside of North America, as reported in The New York Times. This step was a response to experts who, over the past months, have expressed concerns about the re-routing of Chinese metals into the US through countries not subject to tariffs, mainly Mexico, according to Reuters. Foreign Policy Magazine reports that US trade with Mexico supports millions of US jobs. This explains the Biden administration’s growing unease about China using its main trade partner to circumvent tariffs imposed to prevent unfair trade practices and create jobs in key sectors vital for America’s future.

While concerns about China strengthening its relations with Mexico are based on real evidence of an increase in Chinese investments in Latin America, they often fail to consider the broad economic context, reports Foreign Policy Magazine. An overview of the magnitudes of capital flows, new investments, and trade patterns suggests that China’s role in Mexico’s wealth production—while growing—remains limited in comparison to that played by the US and its other key partners.

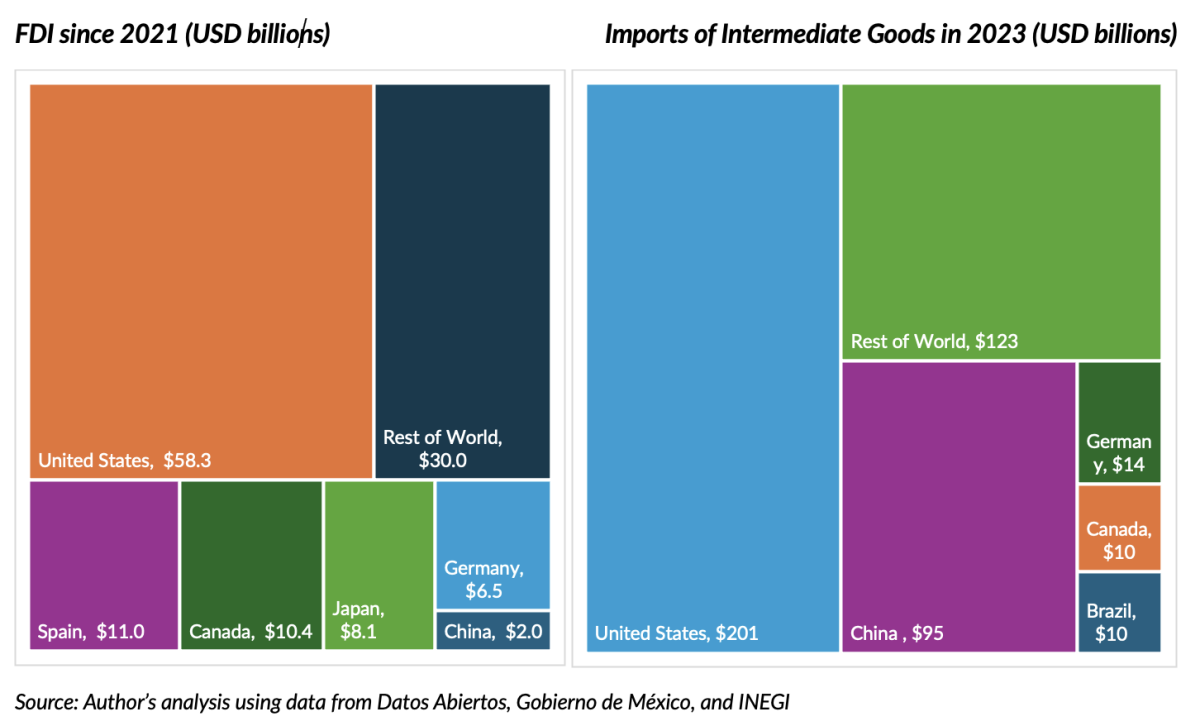

Based on trends, it is true that capital inflows from China (including mainland, Hong Kong, and Taiwan) to Mexico are growing. Chinese quarterly foreign direct investment (FDI) inflows to Mexico averaged $64.5 million between 2016 and 2020, while they had risen to an average of $153.5 million by 2021 to 2024 (Q1). Still, the magnitude of Chinese FDI flowing to Mexico gets dwarfed by the capital Mexico receives from the US: Since 2021, US investments in Mexico totaled $58.3 billion, compared with $2.0 billion of Chinese capital. Overall, Chinese investments still represent less than 2 percent of the total FDI flowing into Mexico, with the list of Mexico’s main investors including Spain, Canada, and Japan, one of Mexico’s main Asian economic partners.

China Compared to Mexico’s Main Economic Partners

Another important factor affecting the North American strategic objective of building resilient supply chains is Mexico’s imports of intermediate products from China, as explained in an executive order. On this metric, China does contribute more to Mexico’s economy (as the second main source of its intermediate imports). However, the share of Mexico’s intermediate imports from China has remained fairly stable, hovering around 20 percent since 2018. The US is by far the largest source of Mexico’s imports, representing 44.3 percent of its imports of intermediate goods.

It is also important to remember that goods assembled and produced in Mexico have a substantial North American value-added. Consider, for example, the production occurring in Hofusan Industrial Park, one of the largest Chinese-Mexican industrial parks. One of the firms producing in Hofusan is Man Wah Furniture factory (which produces goods sold in the US). As expressed by Yu Ken Wei (the factory’s manager) in an interview with the BBC, the company hopes to employ more than 1,200 Mexican workers in the coming years, with its goods being made by Mexicans working at relatively high productivity levels. Based on recent estimates, SciELO reports that Mexico’s exports have about 65 percent of domestic value-added, with another 13 percent of value-added from the US and Canada. This suggests that Mexico’s exports contain more than three-fourths of North American value (even though there is admittedly large variation depending on the industry and type of good).

In sum, the single country that contributes most to Mexico’s economy and production is still the US, by far. While there is little doubt that the administration of Claudia Sheinbaum, PhD—Mexico’s incoming president—will have to display considerable care in navigating its relationships with China, Mexico is already working with the US on strengthening the resilience of North America’s supply chains. According to both Mexican and American government officials, as reported in El Financiero and The New York Times, the recent tariffs imposed by the US on imports of steel and aluminum from Mexico targeting Chinese metals were the result of an agreement between the two countries aimed at protecting North American economic security. As the favorable conditions driving capital (including Chinese capital) into Mexico continue, North American countries will need to maintain their close cooperation to ensure the success of their commercial agreements and the region’s economic well-being.