Milken Institute Finance

Milken Institute Finance tackles challenges across the financial system through thought leadership, research, and insights to influence private-sector practices and public-sector policies to improve fair access, efficiency, and reliability of markets and institutions.

Finance Pillar Highlight

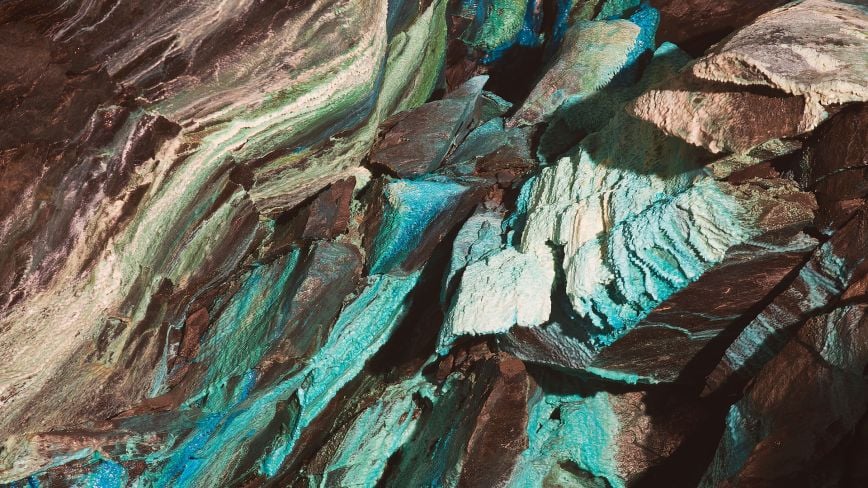

Investing in the Future – Innovations in Critical Mineral Supply Chains

Finance Portfolios

Featured Thought Leadership

-

Generosity After the LA Fires: Charitable Giving and the Road Ahead to Rebuilding

In the aftermath of the devastating Eaton and Palisades Wildfires in Los Angeles, philanthropic institutions, corporations, community-based organizations, and individuals generated a significant cross-sectoral charitable giving response—and...Read ReportImage

Alexander Meeks

Director, 10,000 Communities Initiative, Milken Institute FinanceAlexander Meeks is a director at Milken Institute Finance. He focuses on helping communities accelerate resilient disaster recovery and adapt to extreme weather events. -

Milken Institute and Oliver Wyman Report Reveals Reforms Needed to Meet the UK and Europe’s Defence Readiness Gap

Munich, Germany (February 14, 2026)—Today, the Milken Institute and Oliver Wyman released a report detailing the current gaps in European military readiness and the barriers to securing the financing needed to address them by 2030.Read ArticleImage

Rose Prinelle

Associate Director, InternationalRose Prinelle is an experienced associate director for the International team, bringing more than ten years of experience from the world of business-to-business (B2B) technology communications to her role, where she leads the Institute’s integrated communications programme in the Europe, Middle East, and Africa region. -

Digital Financial Infrastructure in Focus

The world’s financial system operates at digital speed, but much of its infrastructure remains slow, fragmented, and opaque.Read Report -

Financial Innovations Labs Newsletter: 2025 Recap and 2026 Updates

In This Newsletter Financial Innovations Labs Updates Continuing Lab Outcomes 2025 Events and Convenings Highlights Recent Publications Upcoming Events Financial Innovations Labs Updates Current projects underway: Financing the Future of...Read Article -

Capitalizing Community Lenders to Expand Affordable Small Business Finance

Across the United States, small businesses are essential drivers of job creation, innovation, and local economic resilience. Yet for many entrepreneurs—particularly those in low-income communities and communities of color—access to...Read ArticleImage

Camron Doss

Director, Milken Institute FinanceCamron Doss is a transformative senior leader with more than 30 years of specialized experience in strategic planning, stakeholder relations, external affairs, corporate communications, community and economic development, and business operations. At the Milken Institute, Doss leads the Initiative for Inclusive Entrepreneurship.

-

2026 Policy Priorities and Solutions

The Milken Institute is a nonprofit, nonpartisan think tank focused on accelerating measurable progress on the path to a meaningful life. With a focus on financial, physical, mental, and environmental health, we bring together the best...Read Brief -

Fayetteville–Springdale–Rogers, AR and St. George, UT Top Milken Institute’s 2026 Annual Ranking of Best-Performing Cities

The Milken Institute's 2026 Best-Performing Cities report ranks 411 US cities based on labor market strength, high-tech sector growth, housing affordability, and access to economic opportunity.Read ArticleThe Milken Institute's 2026 Best-Performing Cities report ranks 411 US cities based on labor market strength, high-tech sector growth, housing affordability, and access to economic opportunity.

Image

Sam Roth

Associate Director, Media RelationsSam Roth is the associate director of media relations for the Milken Institute. Based out of the Washington, DC, office, she oversees media coverage for the Health and Strategic Philanthropy pillars. -

Best-Performing Cities 2026: Resilience in a Cooling Economy

Best-Performing Cities 2026: Resilience in a Cooling Economy evaluates the economic performance of 403 US metropolitan areas as growth slows and cost pressures rise. The index ranks metros across key indicators of jobs, wages, and high-tech...View ResearchBest-Performing Cities 2026: Resilience in a Cooling Economy evaluates the economic performance of 403 US metropolitan areas as growth slows and cost pressures rise. The index ranks metros across key...

-

In the Hot Seat: Financing Asia's Heat Resilience

By 2050, nearly 1.2 billion people in Asia are projected to be exposed to lethal heat waves. Without action, heat-related productivity losses alone could reduce regional GDP by 25–30 percent by 2048, threatening competitiveness, food...Read ReportImage

Ella Tan

Associate Director, Asia, Milken Institute InternationalElla Tan is an associate director, Milken Institute International in Singapore. Her current research focuses on vaccination access and delivery, the opportunities and challenges for technology to transform mental health care in Asia, and the role of cloud technology to enhance resilience and advance the Environmental, Social, and Corporate Governance (ESG) goals of the financial sector. -

The New Investor Narrative: Discussion Document

In an era marked by geopolitical volatility, rapid technological change, rising energy demand, and intensifying extreme weather, investor interest in climate resilience remains strong. For investors, climate mitigation, adaptation, and...Read ReportIn an era marked by geopolitical volatility, rapid technological change, rising energy demand, and intensifying extreme weather, investor interest in climate resilience remains strong. For investors...

-

Rebuilding from the Bottom Up: The LA Fires One Year Later

January marks the one-year anniversary of the Eaton and Palisades fires that devastated Altadena, the Pacific Palisades, and Malibu, destroying over 16,000 structures, killing 31 people and leading to hundreds more related deaths, and...Read ArticleImage

Alexander Meeks

Director, 10,000 Communities Initiative, Milken Institute FinanceAlexander Meeks is a director at Milken Institute Finance. He focuses on helping communities accelerate resilient disaster recovery and adapt to extreme weather events. -

One Year After the Fires, A Lesson in Community Resilience

January 7 marks one year since wildfires tore through Los Angeles, making it the costliest wildfire event globally and contributing to more than $130 billion in extreme weather losses in the first half of the year alone.Read ArticleImage

Théo Cohan

Director, Innovative Finance, Milken Institute FinanceThéo Cohan is a director of innovative finance at the Milken Institute, focusing on communications and marketing strategies, and partnerships, and working with her team to develop and execute Financial Innovations Labs®.