Tell us about you and your team.

My name is Samuel Njuguna, and I'm passionate about eradicating poverty through two key pillars: financial inclusion and education. I have a background in computer science and currently serve as the CEO and cofounder of Moneto Ventures LTD.

Moneto Ventures LTD runs Chumz, a goal-based savings and investment app that leverages behavioral psychology and gamification to guide users on how and when to save. For example, users can set rules to save money from discounts on weekend purchases—whether for business or personal use—or automatically round down their mobile money balance to the nearest hundred, making saving effortless and removing the mental burden of deciding how much to set aside.

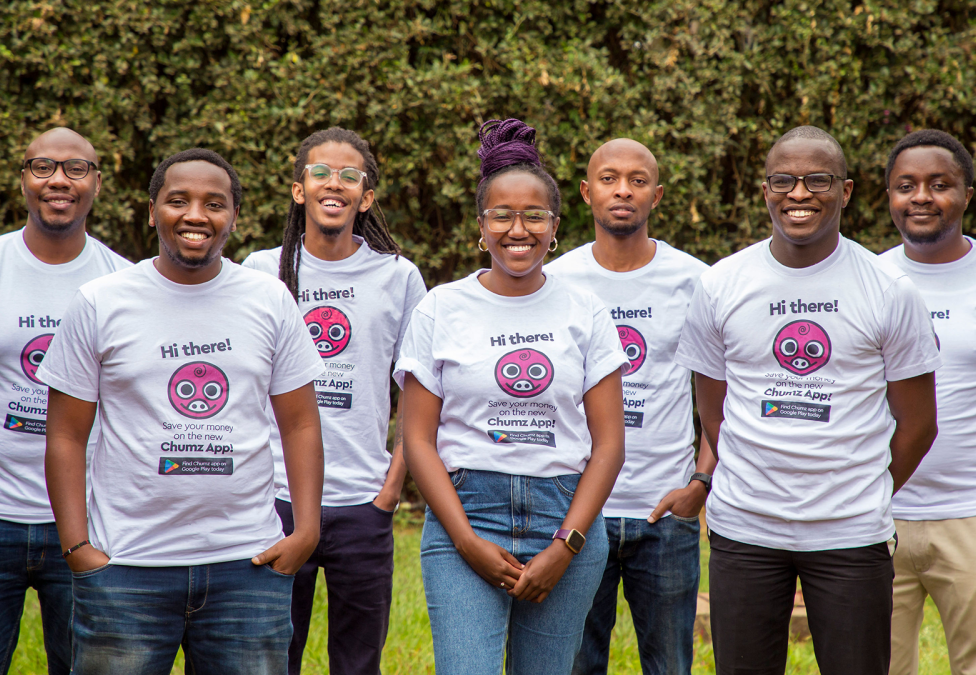

This approach is relatively new and intentionally creative, aligning with our true north: enabling people in sub-Saharan Africa to save and invest effectively. We are a team of 30 people operating in Kenya and Rwanda, composed of software engineers, designers, customer support, marketing, and administrative professionals. We like to think of ourselves as creatives who are deeply passionate about personal finance and dedicated to helping others save and invest.

What inspired you to participate in the Milken-Motsepe Prize in FinTech? In addition to competing for the $1 million grand prize, what do you hope to achieve through this experience?

The key interest in participating in the Milken-Motsepe Prize in FinTech was the opportunity to gain access to a global network of mentors, investors, and influencers. Milken has people who are very entrepreneurial and touch on the finance side, so it was a key focus to see how we could join this wider network.

As part of our expansion plans, we have engaged with individuals who have benefited from Milken's work, especially in the capital markets across various African countries. Being part of this network means we have a common point of reference, which reduces our barrier to forming new relationships and unlocking further opportunities.

We plan to use the funds to expand into Uganda, Tanzania, and Ghana, where we currently have a large waiting list of customers. These markets share similar transaction habits and high mobile money adoption, making them ideal for our growth.

In addition, we aim to enhance auxiliary features by integrating financial literacy components, empowering users to make informed financial decisions. This will require hiring additional engineers to implement and scale these features effectively.

The funding will also support the launch of our content creation hub, which will leverage social media as a key marketing tool to drive engagement and fuel growth.

How will your solution expand access to financial services in emerging and frontier markets, particularly for underserved communities?

By addressing the following key barriers to financial inclusion, we aim to expand access to financial services:

- Remote account opening without the need for an account balance: Users can open and manage an account digitally without the need to travel or set aside an account balance to maintain the account. In many parts of sub-Saharan Africa, accessing financial services often requires traveling to a larger town, which can be costly and time-consuming, if you are in a rural area. Our platform eliminates this barrier, ensuring accessibility even in remote areas.

- Micro-savings and investments: Fund managers in Africa require a minimum ticket size of USD 100 for you to open an account with them, which is a barrier for many smaller retail investors. In our case, we enable users to save and invest with as little as 5 cents. This inclusionary approach ensures that individuals earning less than $1 per day can participate in formal financial services, fostering long-term financial security. Our average saving amount is USD 0.8, which is an amount that traditional banks would not enable users to invest—but in our case, we do.

- Goal-based savings and behavioral nudges: Our app helps users develop consistent saving habits through gamification and behavioral psychology. By making the process engaging and rewarding, we empower individuals who struggle with financial discipline to build sustainable saving and investment practices. We tie the behavioral aspects to the individual lifestyle and spending habits. For example, the app informs users to save when they receive mobile money. A user can custom-set rules to save whenever their favorite football team wins.

- Shifting the market narrative: We are actively promoting a culture of savings and investment in a market dominated by lending solutions with high interest rates to cover the high default rates. By providing an alternative that focuses on financial growth rather than debt, we are helping users build wealth and long-term financial resilience.

Our approach ensures that financial services are available, accessible, affordable, and engaging for those traditionally excluded from the financial system.

How does your team and solution stand out from the other finalists in this competition? What unique qualities or approaches set it apart, and what distinctive impact do you aim to achieve through your solution?

Our team is made up of people who are passionate and eager to learn new ways to improve our solution. Some of our engineers have built core banking solutions for several African banks, and we have second- and third-time entrepreneurs working with us.

Our solution stands out because it enables people to save and invest by utilizing behavioral psychology. Behavioral psychology in savings in sub-Saharan Africa is key to improving the low saving rates, which stand at 8.5 percent—among the lowest in the world. Our approach has resonated with many clients, and we are currently the number one savings and investment app in Kenya and Rwanda.

Clients are building habits and hitting their financial goals. Our data shows that over 65 percent of our savers are women and youth, and the solution resonates with them.

There are four pillars of finance: savings, investment, insurance, and credit. Of these four pillars, we argue that savings are the most powerful because if done right, a client can invest, buy insurance, and get a good credit score for better credit facilities.