Report outlines new financing and care delivery recommendations to make long-term care affordable and accessible

Washington, D.C. - April 8, 2021 - The Milken Institute today released a new report highlighting innovative public and private sector solutions that can expand long-term care access and delivery for middle-income Americans. Published in collaboration with Genworth, “New Approaches to Long-Term Care Access for Middle-Income Households” examines financing, technology, and care challenges of the current system and offers recommendations to overcome these barriers.

Recent studies have found that more than half of middle-income seniors will not be able to afford the care they need. Meanwhile, though the pandemic laid bare the stark vulnerabilities of the long-term care system, it also ushered in a greater use of technology with telehealth and in-home care.

“Middle-income Americans are stuck between being unable to afford private long-term care, and not qualifying for government-sponsored programs like Medicaid. This can lead to a gap in care for a significant portion of the population,” said Nora Super, senior director of the Milken Institute Center for the Future of Aging.

The report comes on the heels of a Financial Innovations Lab® the Milken Institute organized in fall 2020. The Lab convened an expert group of stakeholders from government, health, long-term care delivery, insurance, finance, and academia to develop solutions that can improve access to quality affordable long-term care for middle-income households.

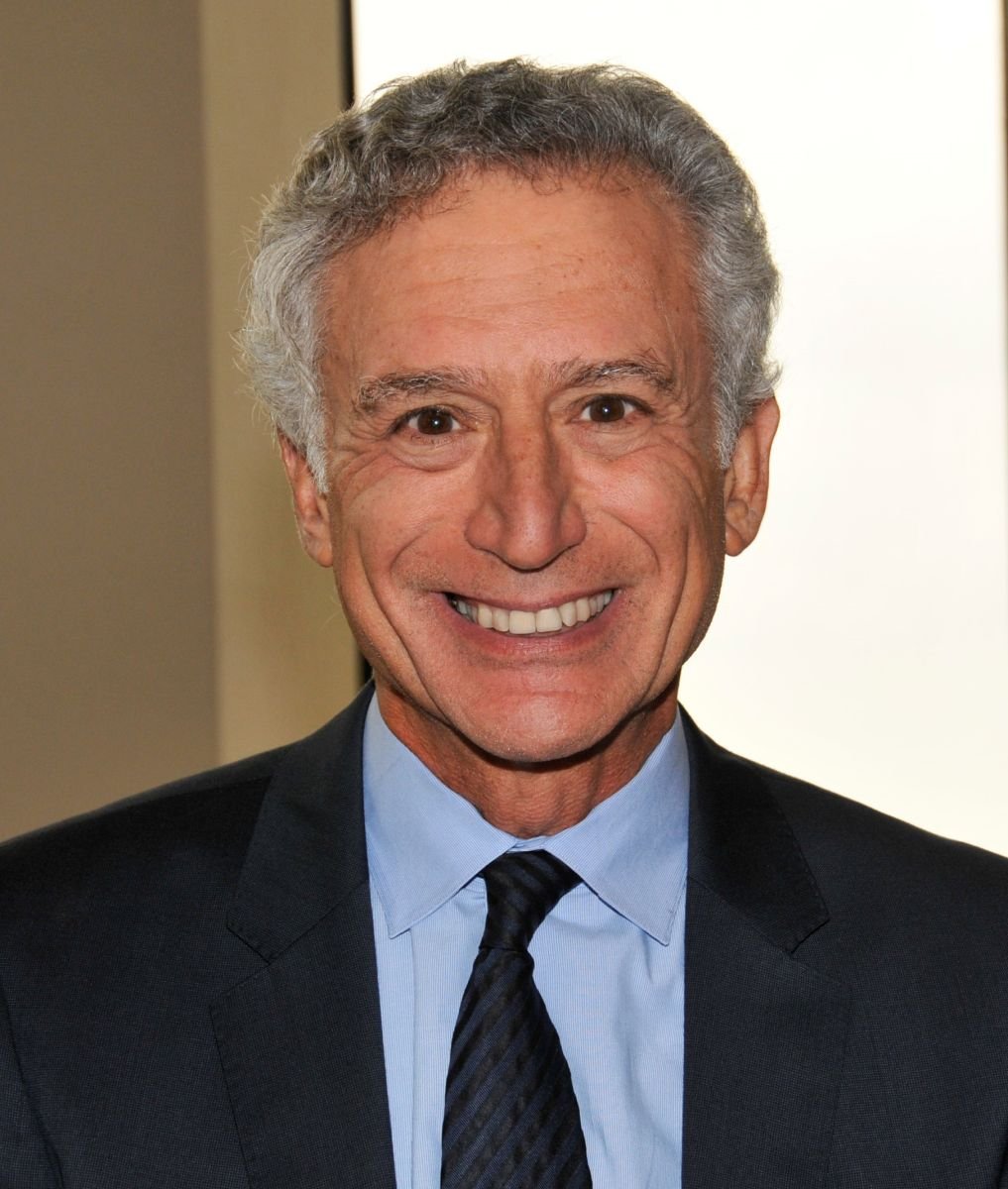

"The pandemic has brought greater awareness to the fault lines that exist in the current long-term care ecosystem. The concrete recommendations outlined in this report are critical to closing the gaps in providing much-needed, meaningful long-term care solutions for millions of middle-income individuals,” said Tom McInerney, President and CEO of Genworth. “It will take collaboration and innovative thinking amongst stakeholders at the federal and state levels, from both the public and private sectors, to take the roadmap established in the report and effect the change that is so desperately needed.”

Building on the Lab and further research, the Milken Institute proposes specific recommendations for public and private collaboration to successfully finance long-term care, including:

-

Design a large-scale demonstration project to better analyze costs and benefits of various technology solutions that enhance home-based care. There are numerous private sector pilot programs measuring the effectiveness of solutions like telehealth and remote monitoring, but these programs do not employ standardized data and evaluation frameworks. The report offers a roadmap for developing a cohesive demonstration project and outlines specific parameters such as demographic profile, evaluation measures, and potential funding sources for successful program design.

-

Expand access to integrated care for middle-income Americans who cannot afford specialized private care programs and do not qualify for Medicaid. The report recommends scaling up promising integrated care programs that are already available in the marketplace, such as Special Needs Plans (SNPs) and Programs of All-Inclusive Care for the Elderly (PACE). Proposed modifications include offering a new community-based SNP or expanded access to PACE via a tiered benefit structure, providing broader access to non-medical supportive services to a much broader cohort.

-

Develop new complementary public-private insurance solutions that offer seamless, affordable coverage and segment risk. Long-term care is too costly for the private or public sectors to tackle alone. In order to mitigate costs and associated risks, the Milken Institute identified a new approach that allows the public sector to develop long-term care insurance programs that address the first couple of years of long-term care costs, followed by complementary private sector long-term care insurance products that provide coverage for additional years. For the most prolonged and expensive cases, Medicaid would continue to act as a backstop. This is a more nuanced approach to risk segmentation than is typical in current models.

Caitlin MacLean, senior director of innovative finance at the Milken Institute added, “These innovative solutions can improve access to high-quality care for older adults while driving down costs for public and private payers alike.”

The Milken Institute will continue leveraging our network, engaging policymakers, and providing a platform to advance these solutions. We encourage stakeholders in the long-term care ecosystem to heed these recommendations and advance quality access to care for Americans across the socioeconomic spectrum.

“New Approaches to Long-Term Care Access for Middle-Income Households” is co-authored by Jason Davis and Caroline Servat. The full report can be downloaded here.

Media Contacts:

Milken Institute:

[email protected] | +1 202 336 8921

Genworth:

Julie Westermann, [email protected], + 1 (804) 937-9273.

About the Milken Institute

The Milken Institute is a nonprofit, nonpartisan think tank that helps people build meaningful lives in which they can experience health and well-being, pursue effective education and gainful employment, and access the resources required to create ever-expanding opportunities for themselves and their broader communities. For more information, visit https://milkeninstitute.org/

About Financial Innovations Lab®

Financial Innovations Labs® bring together researchers, policymakers, and business, financial, and professional practitioners to create market-based solutions to business and public policy challenges. Using real and simulated case studies, participants consider and design alternative capital structures and then apply appropriate financial technologies to them.

About the Milken Institute Center for the Future of Aging

The Milken Institute Center for the Future of Aging elevates awareness, advances solutions, and catalyzes action to promote healthy longevity and financial wellness. Through research, convening, advocacy, and partnership with leaders across key sectors, the Center works to improve lives and build a better future for all ages.

About Genworth Financial

Genworth Financial, Inc. (“Genworth”) is a leading Fortune 500 insurance holding company committed to helping families achieve the dream of homeownership and address the financial challenges of aging through its leadership positions in mortgage insurance and long-term care insurance. Headquartered in Richmond, Virginia, Genworth traces its roots back to 1871 and became a public company in 2004.

Additional Experts Available to Discuss Long-Term Care

-

Marc Cohen, Co-Director, LeadingAge LTSS Center, UMass Boston

-

Richard Frank, Margaret T. Morris Professor of Health Economics, Department of Health Care Policy, Harvard Medical School

-

Jeff Huber, CEO, Home Instead

-

Robert Kramer, Founder & Strategic Advisor, National Investment Center for Seniors Housing & Care

-

Tom McInerney, President and CEO, Genworth Financial

-

Susan Reinhard, Senior Vice President and Director, AARP Public Policy Institute

-

Katie Smith Sloan, President and CEO, LeadingAge

-

Anne Tumlinson, CEO, ATI Advisory