Agriculture and food are responsible for 27 percent of total greenhouse gas emissions. With growing population and wealth, so too will the demand for more and better-quality food. But making more food and nutrition available doesn’t necessarily have to drive up the pressure on the environment. This is where biotechnology comes in—to rewrite this script by changing how food is produced and processed.

Bioengineering advances have enabled a range of animal-free dairy and meat products using microbial protein harvested in fermentation tanks instead of from livestock. Biotech has been deployed to produce animal feed and biofertilizers with less environmental impact.

Asia’s growing demand for processed foods and farm input makes the region an important target for bringing these solutions to customers at scale. Climate change and recent supply-chain challenges have spotlighted the need for strengthening food security and ensuring equitable access to nutrition. Now is a great time to discuss the agrifood biotech innovation opportunity in Asia and the drivers at play to advance future growth.

Asia as a Competitive Production Base for Bio-Based Ingredients

All bio-based ingredients require microbial fermentation. Using tailored feedstock and growth conditions, bioengineers grow a range of different proteins and control their expression.

Some inherent characteristics in Asia make it a natural bio ingredient production base, starting with infrastructure.

China has abundant fermentation capacity and is a leading manufacturer and exporter of fermentation equipment. The main fermented ingredients today are organic acids, amino acids, vitamins, and industrial enzymes. Of these, China ferments 66 percent of the world's amino acids and 77 percent of vitamins. This capacity can fill the gap from the growing protein demand.

Southeast Asia offers abundant feedstock. After Brazil, Thailand is the second largest raw sugar producer, a common fermentation feedstock. Some traditional food companies are creating new value with their raw ingredients. Thai Wah is valorizing tapioca starch for bioplastics, and the Asian team at Dole is upcycling fruit side-streams for enzymes.

Today, Asia is the largest buyer of fermented organic acids and vitamins used for animal feed and food preservation. This market proximity is a key strategic factor for global companies to situate their manufacturing in Asia.

Having specialized scientific expertise is one thing; coordinating these skill sets and demonstrating executional excellence repeatedly is another.

Top-Down Support Sparks Innovations and Clears Roadblocks

Food security and decarbonization are higher on China’s policy agenda than ever, with goals set for carbon emissions to peak by 2030.

As a result, China limited animal antibiotics to only veterinary use in 2016. New animal feed guidelines cut corn and soybean use to reduce import reliance. Environmental regulations also tightened for the petrochemical synthesis industry. Taking heed of these policies, innovators are developing solutions from phages to probiotics to novel growth enhancers to new materials.

In Singapore, innovation-friendly policies are designed to accelerate the pace of biotech. While global regulators are stalling on cell-based foods, Singapore has become the first to approve cell-based meat and the first to grant a food processing license for its manufacturing. These actions sent a powerful statement to entrepreneurs to bring their innovation to Singapore.

China’s Biotech Maintains Strong Market Performance Despite Recent Global Dip

No tech sector can grow without capital support.

In China, the cumulative market value of biotech companies rose from $1 billion in 2016 to $180 billion in May 2021. While global biotech stocks have tumbled recently, Chinese companies continue their strong performances. Cathay and Huaheng maintain PE ratios of over 70x, delivering $90.7 million and $25.1 million in net profit in 2021. The public market performance will continue to have a domino effect on increased venture capital commitments. Over 50 generalist investors in China have backed agrifood biotech investments.

Elements Are Coming Together to Shape Asia’s Biotech Ecosystem

Asia is not one singular territory, and its development pace varies. Asian companies only represent a small fraction of global agrifood biotech. Tailwinds are helping drive the regional bioeconomy. But more is needed to foster a vibrant ecosystem.

Investor enthusiasm for biotech is stronger in China than any other large market. Yet funding a new sector is a marathon and not a sprint. To foster sustained growth, patient capital is vital.

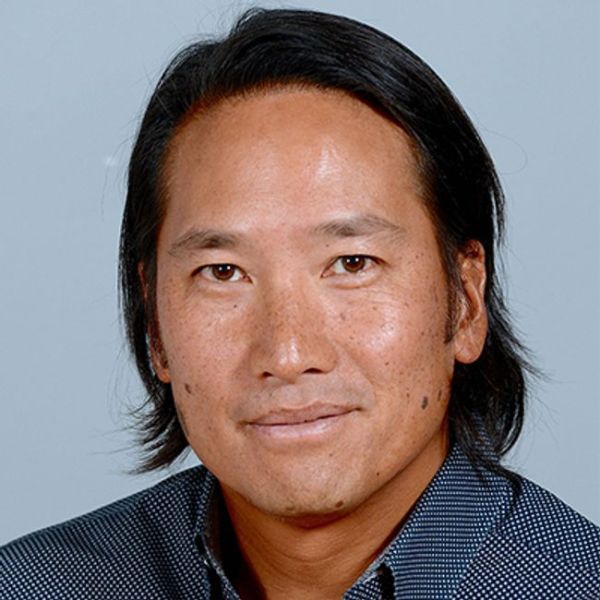

Scientist talent is starting to gather in Asia, thanks to an inflow of western-educated returnees to China and Singapore’s tech ecosystem cultivation. But having specialized scientific expertise is one thing; coordinating these skill sets and demonstrating executional excellence repeatedly is another.

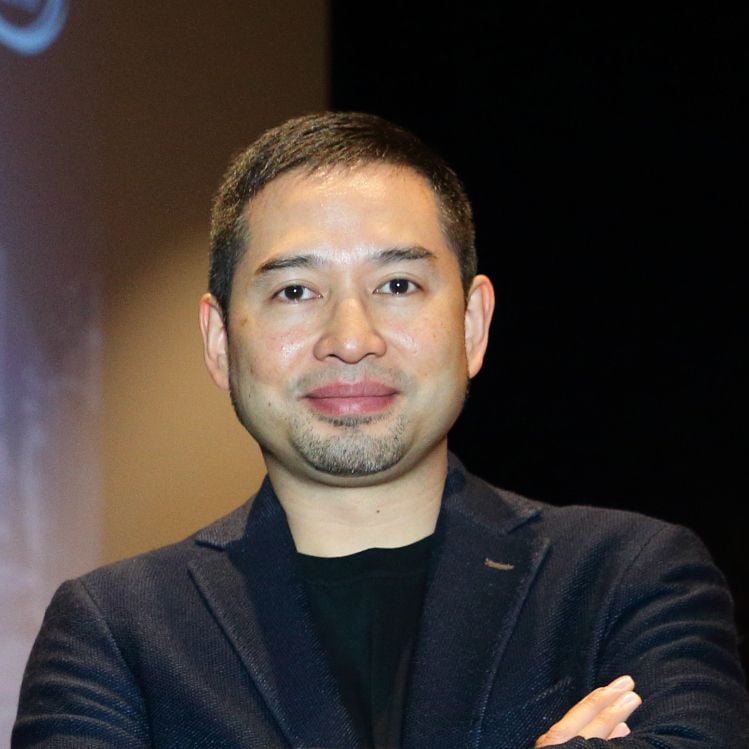

As an investor, we are excited to see more visionary founders with science capabilities and industry experience to build category-defining companies. We look forward to supporting them as they turn the page for Asia’s bioengineering industry and improve its food security and sustainability. There has never been a better time to invent and invest.