The history of pandemics shows that public health crises are profoundly disruptive. Their economic, societal, and geopolitical effects tend to be long-lasting, often unfolding over years, if not decades.

All of this means investors should expect governments to change their priorities, companies to embrace new business models, and citizens and consumers to reassess their needs.

Upheaval is certain. Yet there are several different paths the world could take. At Pictet Asset Management, we have conducted a study in partnership with the Copenhagen Institute for Futures Studies to understand better how the investment landscape might evolve in the next five to 10 years. The research presents investors with four scenarios that might plausibly unfold in the wake of the coronavirus pandemic—scenarios that depend on the choices we make.

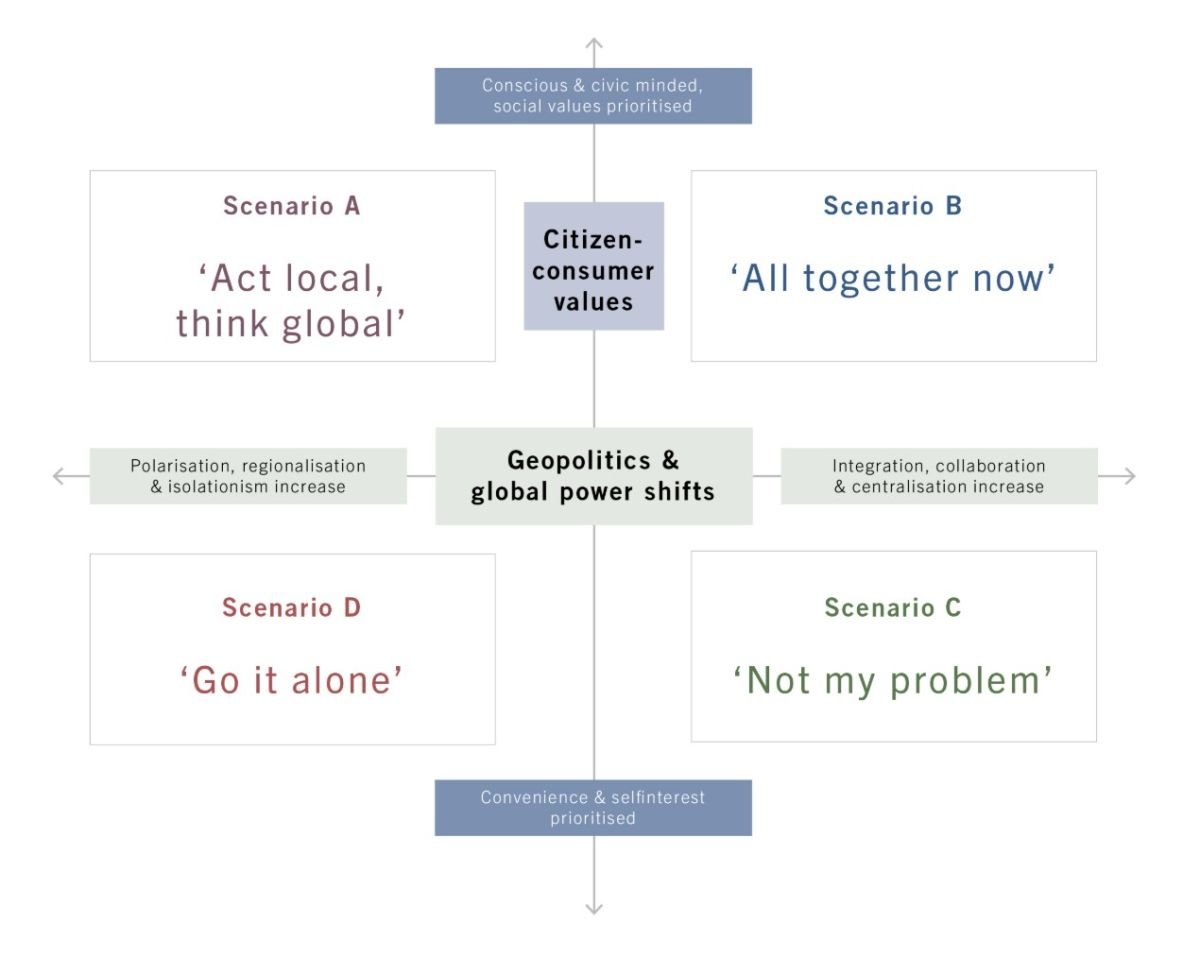

We have produced a scenario grid that maps out four possible futures (see chart below).

Each scenario is characterized by a distinct economic, societal, and geopolitical landscape. And each has its own implications for investors—industries and companies that thrive in certain environments might struggle for their very survival in others.

Under scenario A, Act local, think global, citizens emerge from the public health crisis with a new moral purpose, having come to accept that inequality and environmental degradation can only be reversed through collective action. National governments, by contrast, turn inwards, introducing measures to protect national industries and intellectual property. In this scenario, global productivity and trade suffer as protectionism inhibits international cooperation. On the other hand, localism thrives, boosting industries that are able to adapt products and services to meet consumers’ changing needs.

Investors should expect governments to change their priorities, companies to embrace new business models, and citizens and consumers to reassess their needs.

In scenario B, All together now, the world recovers from the ravages of the pandemic with a renewed sense of solidarity. Governments and citizens the world over come to a shared vision for a more inclusive and sustainable economy and work in tandem to achieve that goal. The world transitions from a largely unipolar world directed by the US into a multi-polar one in which nation-states and international organizations collaborate more closely to tackle climate change and deep-rooted societal problems. Under this scenario, investments in environmental technology and renewables increase while governments also introduce new policies to protect vulnerable communities and give workers enhanced rights. Such measures come with a cost, however. Rates of economic growth fall below the long-term trend as tighter regulations and higher corporate tax rates stifle innovation and competition.

In scenario C, Not my problem, the pandemic has alerted policymakers to deep-rooted problems they had long neglected. There is broad agreement among the world’s largest economies that inequality, poor social mobility, and environmental damage are global threats that require global solutions. Citizens take a different view, however. The experiences of the pandemic have left large swaths of society feeling overwhelmed by the sheer complexity of life in the 21st century. Turning inwards, citizens prioritize their own livelihoods and financial security and disengage from political discourse and community life. All of this means government efforts to transition to a more inclusive economy struggle to deliver in the face of intransigence from the wider population.

In scenario D, Going it alone, the world is a less optimistic place. Citizens emerge from the shadow of COVID-19 with little or no confidence in governments’ ability to address the problems laid bare by the virus. They are more pessimistic about their future, disengaging from the political process. Ethical and environmental considerations and the idea of “shared sacrifice” no longer hold sway. For their part, and similarly stung by the experiences of the COVID-19, nation-states turn inwards to safeguard their natural resources, industries, and workers. International cooperation is limited, which means little or no progress is made in tackling global problems such as environmental degradation and social inequality.

It is important to point out that none of the scenarios we have constructed are forecasts. Neither do we see one future state as being more likely than another. Rather, the scenarios should serve as a starting point for long-term planning and strategic asset allocation. In other words, we aim to ensure investors are asking the right questions.