As a philanthropist, you can set an intention for your resources and define how to deploy your assets. Be sure to consider the value of your entire financial portfolio and support social change efforts in various ways to ensure that all of your investment activities align with your charitable priorities.

Beyond simply writing a check or making a grant to a nonprofit, you can engage in philanthropy across the full spectrum of financial activities, including:

-

Impact and equity investments

Impact investing consists of supporting organizations that are dedicated to creating social or environmental benefits. Financing mission-driven companies and organizations is another way to put your dollars behind the issues that matter most to you. In addition to knowing your money is making a difference, this impact investing provides an opportunity to generate financial returns. For example, philanthropist Pierre Omidyar transformed his family foundation into a limited liability company (LLC) called Omidyar Network to engage in both traditional grantmaking and impact investing. This enables the entity to support for-profit and nonprofit social enterprises that address societal problems. -

Divest from companies that harm people or the planet

In most cases, the best step you can take toward realizing your philanthropic vision is to prioritize purpose over profit. If you happen to have investments in companies that have a net negative impact on our planet or its people, consider reallocating those funds to a worthier organization. Adhering to this practice aligns your investments with Environmental, Social, and Governance (ESG) standards. For example, driven by their commitment to environmental sustainability, Eric and Wendy Schmidt committed to divesting their family foundation's endowment portfolio from fossil fuel stocks. -

Political contributions and lobbying

While contributing to an advocacy organization or a political candidate may not immediately register as a philanthropic effort, it certainly can be. Elected officials have the power to advance initiatives and garner the support and resources needed to impact meaningful change. Leveraging your funds to promote a policy or the campaign of a candidate who shares your commitment to key social or environmental issues is a great way to ensure these matters get the attention they deserve. For example, in addition to grantmaking, philanthropists John and Laura Arnold uses their LLC—Arnold Ventures—to engage in advocacy that advances evidence-based policy reforms.Your giving vehicle will determine the extent to which you can engage in lobbying and policy work. LLCs offer the most flexibility and writing personal checks as an individual also allows for deep engagement in these efforts. A private foundation can also participate in advocacy, albeit with more restrictions. Read our “Advocacy as a Philanthropic Practice” article for more information.

Innovative Use of a Foundation’s Financial Capital

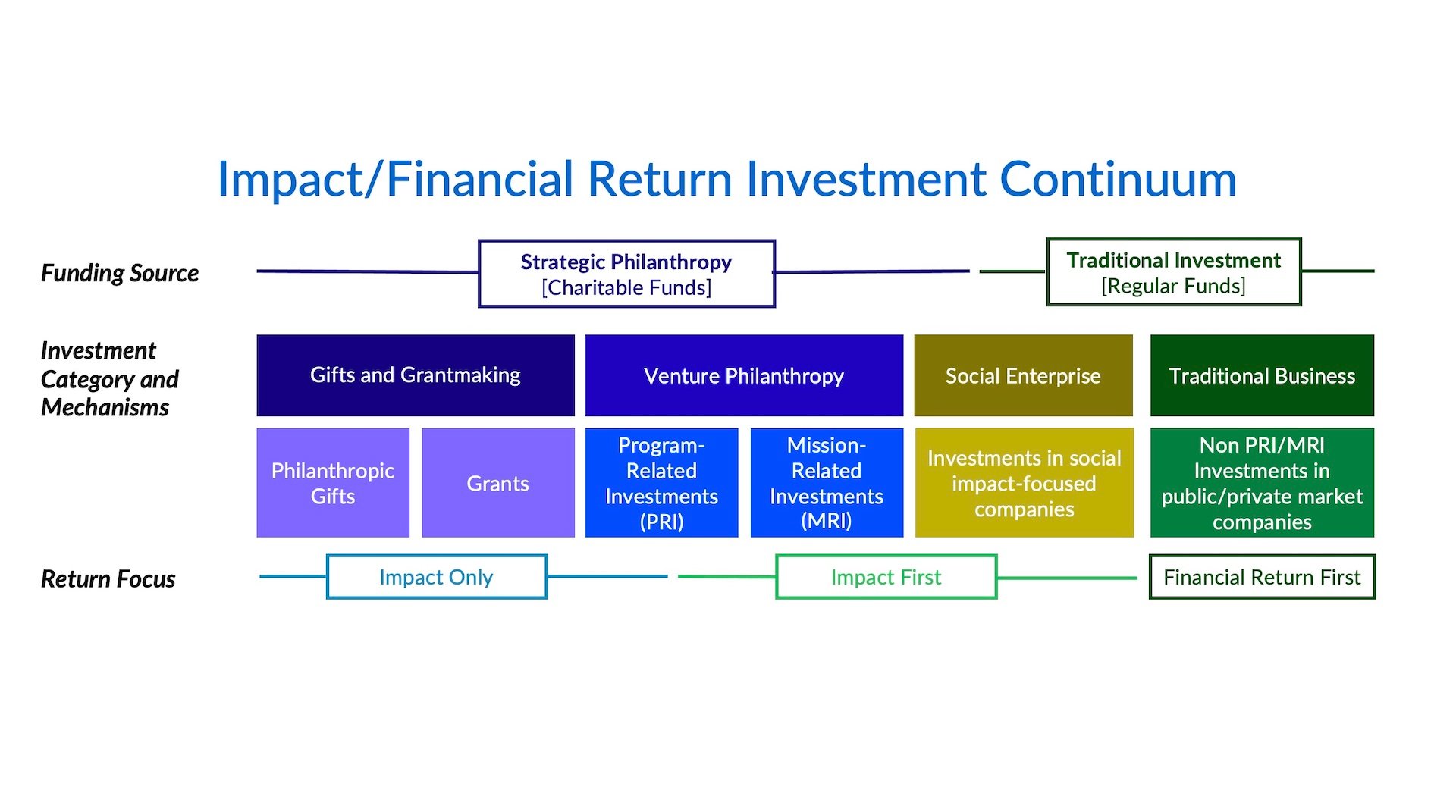

If you conduct philanthropy through a private foundation, you can maximize your impact by using 100 percent of your balance sheet assets. In addition to grantmaking, private foundations are legally permitted to engage in program-related investments (PRIs) and mission-related investments (MRIs).

-

Program-related investments: Foundations are allowed to invest in charitable activities at market or below-market rate of return so long as the investment is made in pursuit of the foundation’s charitable mission rather than to generate income. PRIs qualify as part of a private foundation’s 5 percent required annual payout. For example, as a part of its commitment to new vaccine development, the Gates Foundation made PRIs in for-profit biotech startup companies. This investment allows the Gates Foundation to compel these startup companies to bring their solutions to helping impoverished populations in developing countries. In addition, PRIs can help startups that are otherwise unviable to become successful. As a philanthropy, the Gates Foundation can accept a below-market rate of return on their PRI, whereas most commercial investors cannot. Therefore, startup companies can use the Gates Foundation’s investment to cover the first financial losses, thereby protecting the return of commercial investors to secure access to more long-term commercial capital.

-

Mission-related investments: Foundations are allowed to make market-rate investments that further their mission as a part of their investment strategy used to grow the foundation’s endowment. While MRIs do not qualify as part of a private foundation’s 5 percent required annual payout, they do allow foundations to magnify their impact while maintaining growth in endowments. For example, the F.B. Heron Foundation has transitioned its entire endowment (nearly $300 million) for investment in areas related to its mission. Doing so enables the foundation to align its charitable and investing activities and achieve greater impact in its focus areas.

Financial Investment Options When Supporting Nonprofits

When making grants or financial gifts to nonprofits, you can choose to meet a specific objective. Determine whether one aspect of a nonprofit’s development or endeavors resonates most deeply and decide whether your philanthropic resources will target those efforts. For example

-

You can choose to offer seed, emergency, or bridge funding if you wish to fill an in-demand niche to bolster an under-resourced nonprofit sector.

-

If you hope to scale solutions, supporting nonprofit capacity building and measurement, learning, and/or evaluation efforts is an option. Funding nonprofit infrastructure has been historically underfunded and, therefore, it is a huge area of need across the sector.

-

Unrestricted, general support is the most flexible kind of aid a philanthropist can offer, which empowers organizations to operate as needed to best achieve their mission. You can opt for this designation to allow a nonprofit to remain nimble and make its own strategic operating decisions.

Bottom line: Your financial assets can play a varied role in accomplishing your philanthropic pursuits—leverage all the opportunities that align with your values and interests.

Additional Resources:

-

Learn about the 100% Network, the growing movement of philanthropists choosing to utilize their foundations’ entire balance for social good.

-

Join like-minded families who are committed to aligning their assets with their values via The ImPact.

-

Learn more about how supporting nonprofit operations and infrastructure is critical to addressing the starvation cycle facing this sector in this article from The Chronicle of Philanthropy.

-

Not sure how to incorporate risk management into your philanthropy? This guide from the Open Road Alliance provides some suggestions.