Overview

A growing share of technology acquisitions may be reshaping markets without triggering federal antitrust review. Under the Hart-Scott-Rodino (HSR) Act, mergers and acquisitions (M&A) above defined size thresholds must be filed for federal antitrust review before closing. However, many modern tech deals—particularly those aimed at acquiring capabilities rather than eliminating competitors—hover just below these filing thresholds.

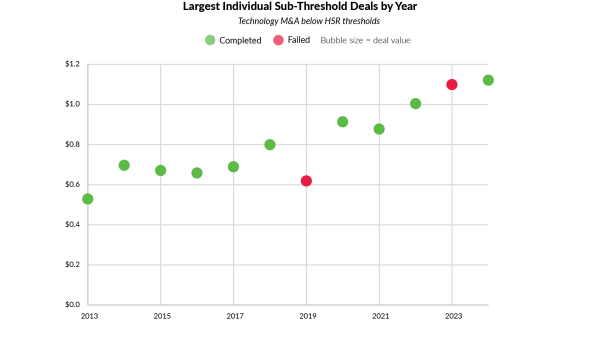

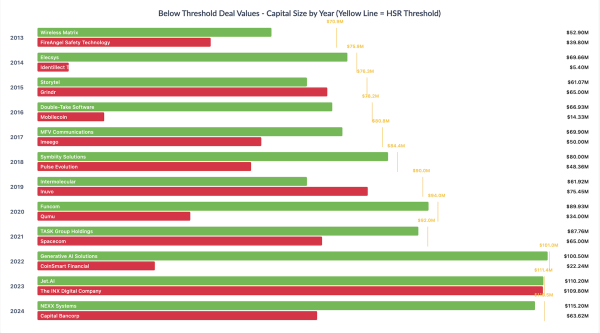

Analysis of major sub-threshold tech transactions from 2013 to 2024 shows increasing precision in deal sizing relative to HSR limits. One recent deal reached 99.5 percent of the filing benchmark, reflecting firms’ careful structuring of transactions to remain just under the line.

Background

The HSR Act requires companies to notify the Federal Trade Commission (FTC) and the Department of Justice of transactions exceeding an annually adjusted size threshold, set at $126.4 million for 2025. Deals above this threshold typically undergo federal antitrust review, with over 80 percent receiving formal investigation. Conversely, deals below this reporting threshold are almost never investigated, creating a regulatory blind spot.

Analysis of US technology M&A activity from 2013 to 2024 shows that 59.3 percent of transactions occurred below the threshold, suggesting that for the tech sector, deal size largely influences which transactions receive federal antitrust review and which proceed without oversight.

A distinct pattern has emerged in recent years: the largest sub-threshold transactions now approach the regulatory threshold with remarkable precision. Transactions involving Generative Solutions in 2022 and Jet.AI in 2023 reached 99.5 percent and 98.7 percent of their respective annual thresholds, according to PitchBook data. This diminishing gap reflects growing sophistication in deal structuring relative to regulatory limits.

Deal structuring also occurs above the reporting threshold. According to a 2021 FTC study analyzing 616 transactions by leading technology firms, 15 percent of deals exceeding HSR thresholds used exemptions to avoid filing disclosure. The most common methods were deferred or contingent compensation—used in 79 percent of exempt deals—where payments are delayed or tied to future company milestones. Another 36 percent involved assuming the seller’s debt. These practices can reduce a deal’s immediate reportable value, potentially bringing transactions below notification requirements.

Public data on sub-threshold deals remain limited, with PitchBook among the most comprehensive available sources. Even so, evidence from these datasets shows that some of the largest unreported technology M&A transactions have taken place in recent years.

Why Is This Important?

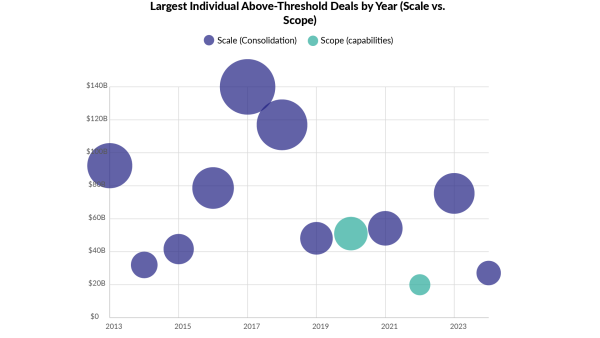

Deal activity in technology increasingly emphasizes expanding key capabilities over consolidating market share. Rising enforcement of large mergers in recent years has prompted firms to pursue more modular, scope-oriented transactions—even at larger deal sizes.

The shift from scale to scope is substantial: According to Bain’s 2024 Technology Report, scope-focused deals now represent 70–80 percent of tech M&A volume, up from a near-even split just a decade ago. Rather than acquiring direct competitors to capture market share—which has historically driven scale-focused consolidation—companies now focus on deals that open adjacent markets or unlock access to specialized technologies and expertise. These ‘scope’ transactions prioritize targeted integration over broad consolidation.

Many scope-oriented transactions never reach formal HSR review. Acquirers often structure deals using modular formats such as licensing agreements, targeted hiring, or cloud service commitments that stay below reporting thresholds or fall outside traditional merger definitions. These arrangements let firms acquire key capabilities while avoiding merger review.

This logic now shapes transactions across deal sizes. Microsoft's $650 million deal with Inflection blended intellectual property (IP) licensing with extensive team transfers, while Amazon’s engagement with Adept similarly separated talent integration from IP control. Apple has employed combinations of licensing, infrastructure access, and selective hiring in deals involving WhyLabs, TrueMeeting, and Mayday Labs. Google’s $2.7 billion licensing agreement with Character.AI focused on securing a key conversational artificial intelligence (AI) capability rather than market share. In each case, the emphasis lies less on corporate control and more on technical integration. Though deal values may resemble those traditionally associated with consolidation, these modular formats often keep firms outside the purview of merger enforcement.

At the same time, cooperative infrastructure investment models are gaining momentum. As the cost and complexity of developing frontier AI models and platforms climb, joint ventures have emerged as a complementary strategy. The Stargate project—a $52 billion partnership between OpenAI, Oracle, and SoftBank—embodies this shift: co-investment enables resource sharing and deployment at scale without triggering merger notification. These arrangements reflect a broader move from ownership toward alignment in firms’ pursuit of foundational capabilities.

This trend contributes to growing concentration across layers of the AI stack (infrastructure, models, and applications). By 2024, nearly 90 percent of notable AI models were developed within large firms, up from 60 percent in 2023.

However, regulatory oversight has not kept pace. Despite growing concern that sub-threshold deals may reduce competition and suppress innovation, fewer than 1 percent of such deals are reviewed by US antitrust agencies. As FTC Chair Lina Khan has observed, "firms have devoted tremendous resources to acquiring start-ups, patent portfolios, and entire teams of technologists," much of which occurs beyond the scope of traditional notification. Meanwhile, the FTC is operating with around 1,100 staff members—its smallest staff in a decade—overseeing a digital economy vastly larger and more complex than in previous decades.

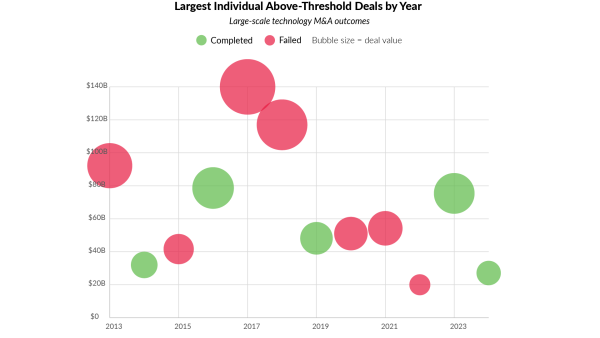

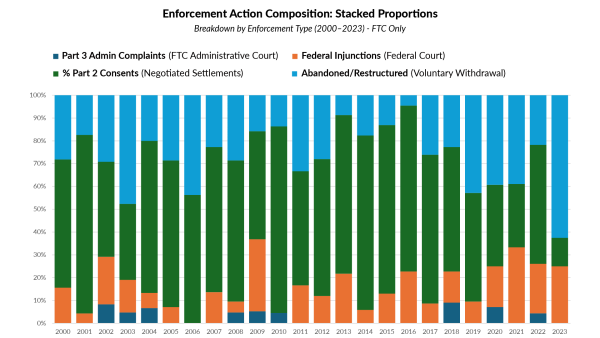

Many high-profile, above-threshold deals face intense enforcement pressure, reflected by a record 62.5 percent voluntary withdrawal rate in 2023—a data series tracked since 2000. Conversely, modular and scope-driven transactions often proceed without formal review, regardless of their size or strategic importance. The result is a widening gap between how consolidation is designed and how it is reviewed.

What Happens Next?

HSR merger rules tightened in early 2025, raising filing fees and expanding documentation requirements for transactions above the reporting threshold. While these changes increase compliance obligations—especially for tech and life science companies—they do not address the structural visibility gaps created by deals structured to avoid mandatory filing thresholds.

Recent signals from the current administration suggest a more permissive posture toward technology mergers, with an emphasis on streamlined reviews and platform content governance rather than market structure enforcement. According to a Skadden analysis of early policy actions, antitrust agencies are expected to focus less on challenging vertical integration, particularly in areas involving AI capabilities or infrastructure investments.

By contrast, international regulators have responded with increasing assertiveness. In early 2025, the UK’s Competition and Markets Authority launched Strategic Market Status regime investigations targeting sub-threshold vertical and serial transactions (patterns of multiple small acquisitions by a single buyer), notably those involving Apple and Google. Similarly, the European Commission’s Digital Markets Act mandates notification for all transactions by designated “gatekeeper” platforms, regardless of size. Australia finalized updated review protocols in 2023 to detect patterns of serial acquisitions previously escaping formal screening.

Proposed reforms aim to close regulatory visibility gaps. These include aggregating serial acquisitions by a single buyer, requiring mandatory reporting in strategic sectors regardless of deal size, or adopting transaction-value thresholds modeled after those in Germany and Austria. Increasing calls for transparency focus particularly on nonreportable deals by dominant platforms in foundational AI and cloud markets, where consolidation of capabilities is accelerating.

As digital markets shift toward vertically integrated ecosystems, the ability to identify and assess capability-driven consolidation depends increasingly on how regulatory frameworks define—and interpret—scale.